All Categories

Featured

Table of Contents

- – Is there a way to automate Policy Loans transa...

- – What is the minimum commitment for Infinite Ba...

- – How do I leverage Infinite Banking For Retire...

- – Infinite Banking Vs Traditional Banking

- – How do I qualify for Financial Leverage With...

- – How secure is my money with Policy Loans?

- – What is Infinite Banking Benefits?

Term life is the best remedy to a temporary demand for protecting against the loss of an income producer. There are much fewer reasons for permanent life insurance. Key-man insurance coverage and as component of a buy-sell arrangement entered your mind as a feasible excellent factor to purchase an irreversible life insurance policy.

It is an elegant term created to offer high valued life insurance policy with ample commissions to the agent and large revenues to the insurance provider. Private banking strategies. You can reach the very same outcome as infinite financial with much better results, even more liquidity, no danger of a plan lapse setting off an enormous tax problem and more options if you utilize my alternatives

Is there a way to automate Policy Loans transactions?

My predisposition is great information so come back right here and learn more posts. Contrast that to the prejudices the promoters of infinity financial receive. Here is the video clip from the promoter utilized in this short article. 5 Errors People Make With Infinite Banking.

As you approach your golden years, monetary safety is a top priority. Amongst the many various economic approaches available, you might be listening to an increasing number of about unlimited banking. Infinite Banking concept. This idea makes it possible for practically any person to become their very own bankers, providing some advantages and flexibility that can fit well right into your retired life strategy

What is the minimum commitment for Infinite Banking?

The financing will certainly build up easy rate of interest, yet you keep adaptability in establishing settlement terms. The rates of interest is also commonly less than what you would certainly pay a conventional financial institution. This sort of withdrawal enables you to access a section of your money worth (approximately the quantity you have actually paid in premiums) tax-free.

Several pre-retirees have issues regarding the security of boundless banking, and for excellent factor. The returns on the cash worth of the insurance coverage plans might vary depending on what the market is doing.

How do I leverage Infinite Banking For Retirement to grow my wealth?

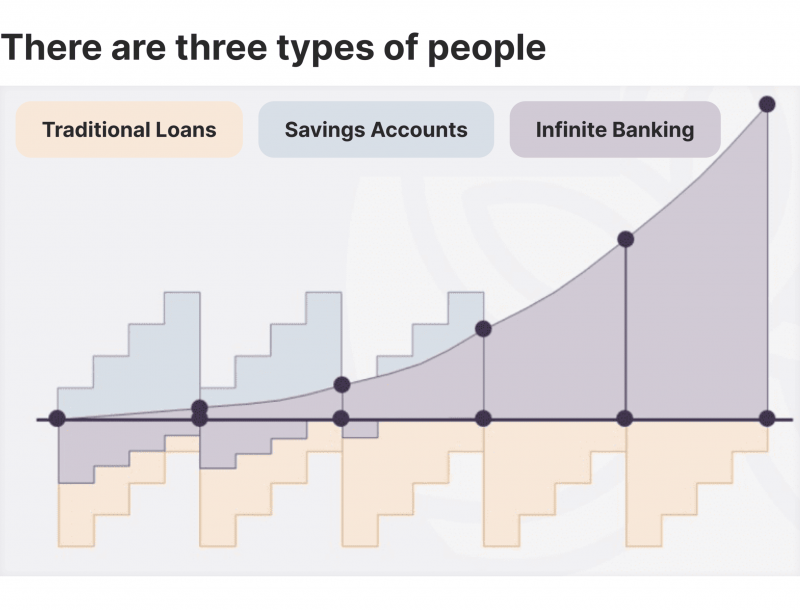

Infinite Financial is an economic approach that has actually acquired significant interest over the previous few years. It's an unique technique to taking care of individual funds, allowing individuals to take control of their cash and produce a self-sufficient financial system - Infinite Banking vs traditional banking. Infinite Financial, likewise understood as the Infinite Banking Concept (IBC) or the Bank on Yourself method, is a monetary technique that involves making use of dividend-paying entire life insurance policy plans to develop a personal financial system

To comprehend the Infinite Banking. Idea method, it is consequently crucial to offer a review on life insurance policy as it is an extremely misunderstood possession course. Life insurance coverage is a crucial component of monetary preparation that gives lots of benefits. It is available in many forms and sizes, the most usual types being term life, whole life, and universal life insurance coverage.

Infinite Banking Vs Traditional Banking

Allow's discover what each kind is and just how they vary. Term life insurance coverage, as its name recommends, covers a certain duration or term, typically between 10 to thirty years. It is the simplest and often one of the most cost effective kind of life insurance policy. If the insurance policy holder dies within the term, the insurance coverage firm will pay the fatality advantage to the designated recipients.

Some term life plans can be restored or converted right into a long-term plan at the end of the term, but the costs generally raise upon renewal as a result of age. Entire life insurance policy is a type of irreversible life insurance policy that gives protection for the policyholder's entire life. Unlike term life insurance policy, it consists of a cash money worth component that grows gradually on a tax-deferred basis.

Nonetheless, it is essential to keep in mind that any kind of exceptional finances taken versus the policy will reduce the death advantage. Entire life insurance policy is commonly more expensive than term insurance coverage because it lasts a life time and constructs cash money worth. It additionally supplies foreseeable costs, implying the expense will not boost in time, supplying a level of assurance for policyholders.

How do I qualify for Financial Leverage With Infinite Banking?

Some factors for the misunderstandings are: Intricacy: Entire life insurance policy policies have extra intricate features compared to call life insurance policy, such as money value build-up, dividends, and policy finances. These attributes can be challenging to comprehend for those without a history in insurance or individual money, bring about confusion and misconceptions.

Bias and false information: Some people may have had unfavorable experiences with whole life insurance policy or heard tales from others who have. These experiences and unscientific information can contribute to a biased view of whole life insurance policy and perpetuate misunderstandings. The Infinite Financial Idea strategy can just be executed and performed with a dividend-paying whole life insurance policy policy with a common insurer.

Whole life insurance policy is a sort of permanent life insurance policy that supplies protection for the insured's entire life as long as the premiums are paid. Whole life policies have two primary components: a survivor benefit and a cash money value (Infinite Banking retirement strategy). The survivor benefit is the amount paid out to beneficiaries upon the insured's death, while the money worth is a savings component that expands in time

How secure is my money with Policy Loans?

Returns settlements: Shared insurer are owned by their policyholders, and therefore, they may disperse profits to policyholders in the form of returns. While rewards are not assured, they can assist enhance the cash money value growth of your plan, increasing the general return on your funding. Tax advantages: The money value development within a whole life insurance policy plan is tax-deferred, suggesting you don't pay taxes on the growth until you withdraw the funds.

Liquidity: The cash worth of a whole life insurance policy is extremely fluid, enabling you to gain access to funds quickly when needed. Asset security: In numerous states, the money value of a life insurance plan is safeguarded from creditors and claims.

What is Infinite Banking Benefits?

The policy will certainly have immediate cash money value that can be positioned as security thirty days after funding the life insurance policy policy for a revolving line of credit scores. You will certainly have the ability to access with the revolving line of credit score as much as 95% of the offered cash worth and make use of the liquidity to money a financial investment that provides earnings (capital), tax benefits, the opportunity for gratitude and leverage of other individuals's ability, capabilities, networks, and capital.

Infinite Financial has become really preferred in the insurance world - a lot more so over the last 5 years. Numerous insurance policy representatives, around social networks, claim to do IBC. Did you recognize there is an? R. Nelson Nash was the designer of Infinite Banking and the company he established, The Nelson Nash Institute, is the only organization that formally accredits insurance agents as "," based on the complying with criteria: They line up with the NNI criteria of professionalism and values.

They effectively finish an apprenticeship with an elderly Authorized IBC Professional to ensure their understanding and ability to apply every one of the above. StackedLife is Accredited IBC in the San Francisco Bay Area and works nation-wide, assisting customers understand and carry out The IBC.

Table of Contents

- – Is there a way to automate Policy Loans transa...

- – What is the minimum commitment for Infinite Ba...

- – How do I leverage Infinite Banking For Retire...

- – Infinite Banking Vs Traditional Banking

- – How do I qualify for Financial Leverage With...

- – How secure is my money with Policy Loans?

- – What is Infinite Banking Benefits?

Latest Posts

Byob: How To Be Your Own Bank

Become Your Own Bank

Bank On Yourself Strategy

More

Latest Posts

Byob: How To Be Your Own Bank

Become Your Own Bank

Bank On Yourself Strategy